Many sellers call us in this current real estate market to see if seller financing is a logical way to sell their home. The answer to the question, “Is seller financing right for me?” is that it depends on your circumstances.

In a call with our Skelly specialists, we would ask you the following questions to determine if you should sell with seller financing.

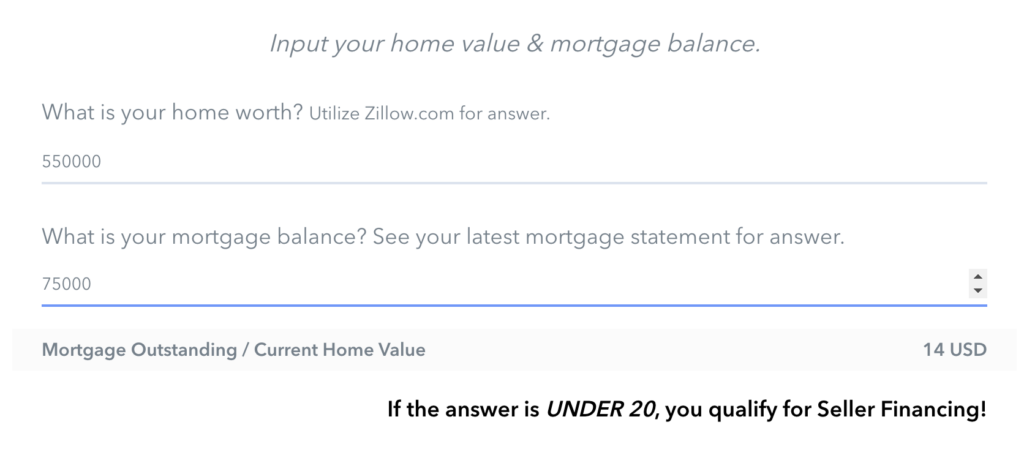

- What is the current market value of your home? (We can help you with this or zillow.com can get you a close estimate.

- What is your mortgage balance?

These two questions will help us determine a number for you that will tell us if seller financing is a good idea for you as a seller. From there, you can determine how long the life of the seller financed loan will be (15 or 30 years) and what interest rate you want to charge as a seller.

For example, let’s say my home is worth $550,000 and I only have $75,000 remaining on my mortgage balance. As a seller interested in seller financing, that would give me a numerical value of 14. Any numerical value under 20 qualifies for seller financing!

Home Value & Mortgage Balance

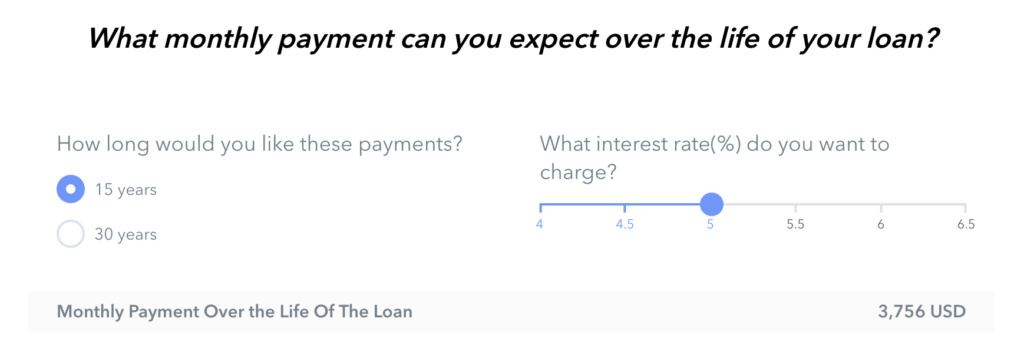

Once I know that seller financing is a good fit for me, I can then determine the length and interest rate of my loan. For example, if I determine a 15 yr loan at 5% interest, then the calculations tell me that I can expect to receive $3,756 of monthly income over the life of the loan.

Monthly Payment Paid to You

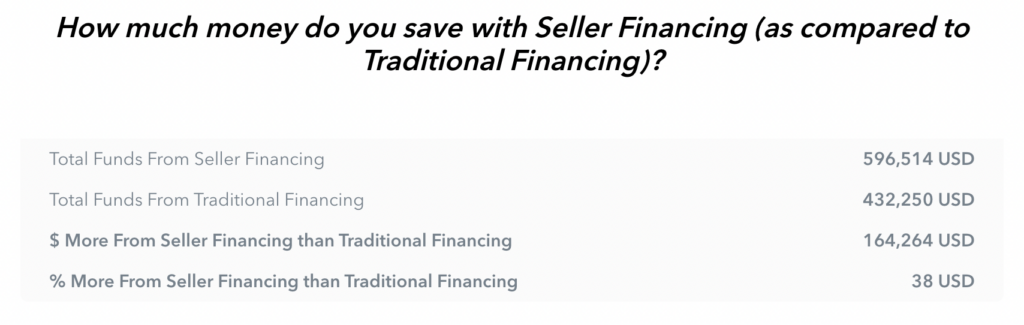

Traditional Financing vs Seller Financing Returns

Every seller is different, but our calculations are a reliable guide to let you know if you should consider seller financing for your set of circumstances.

Why not give it a try? Click the button below to see if seller financing is a good option for you to consider in the sale of your home!