2023 has been a tough year for buying in the real estate market. As inflation spikes, the Fed continues to increase interest rates in an effort to stabilize the economy. Unfortunately, buyers are seeing interest rates continue to increase every quarter. In fact, at the time of this blog writing, interest rates are currently the highest they have been in the 2000s and are well on their way to the 8% or 9% interest rates of the 1980s and 90s.

As a buyer in this market, what are your options? Even the there are many good first time homebuyer programs out there and introductory interest rates, the overall amount you will pay in interest is currently higher than it has been in the past decade.

However, there is a creative option on the table for buyers who buy with Skelly Agency. Seller Financing is a creative solution that helps buyers secure the best interest rate in this current market. In seller financing, it is the seller who becomes the bank and the seller who determines the terms of the loan. Therefore, many of the traditional fees and current high interest rates can be avoided. Let’s take an example to see how seller financing works…

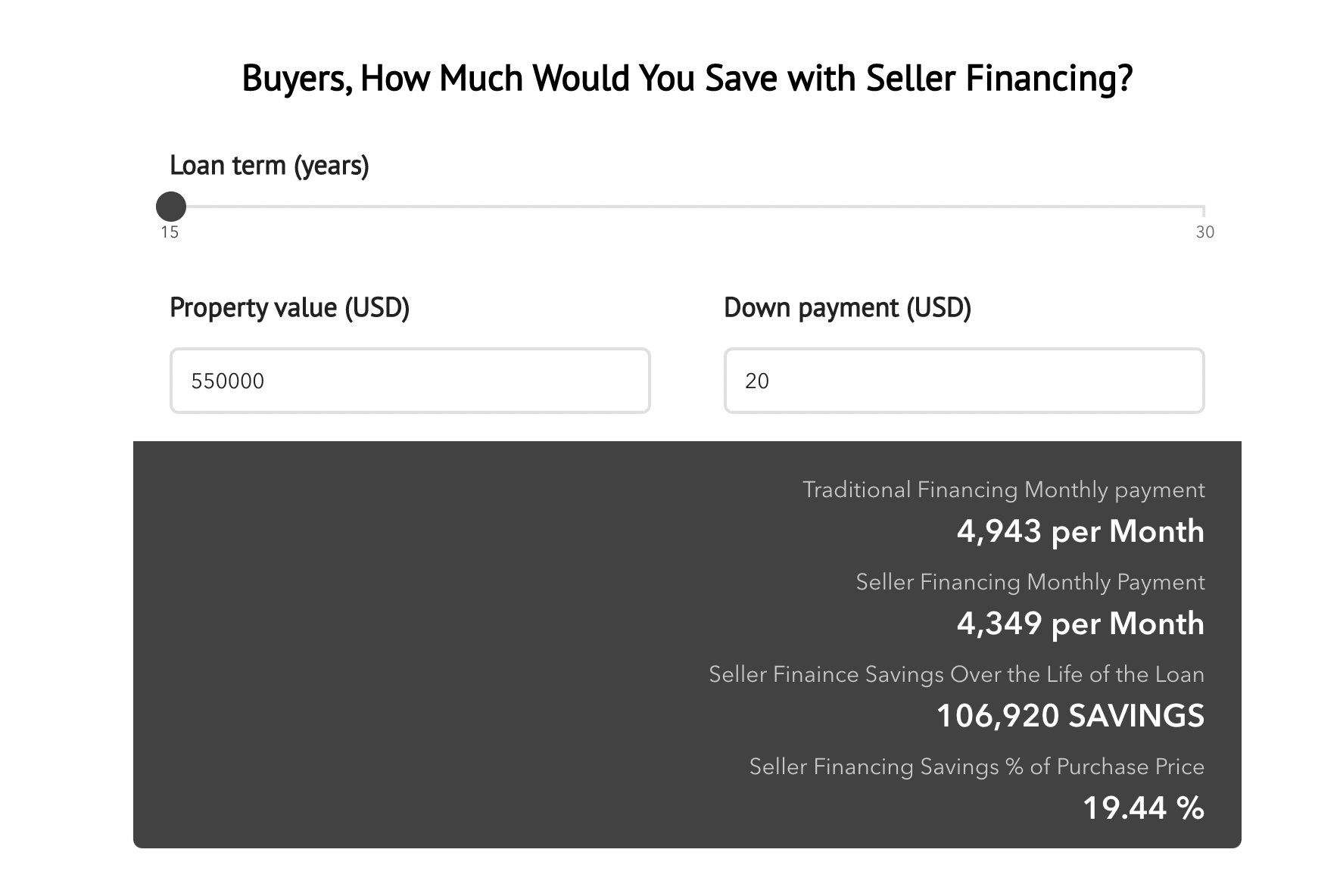

Home Purchase Price: $550,000. Amount Down: 20%. Interest Rate: 5%. Loan Length: 15 years

With this example, using the 5% interest rate and terms set out by the seller, the buyer can save $106,920.00 or 19% over the course of their loan. Just think what other properties or investments you could be making with that $106,000 versus losing it all to a higher interest rate!

Does seller financing make sense for you as a buyer? Click the button below and enter your details to see your customized results!

Does seller financing make sense for you as a buyer? If so, set up a complimentary seller financing advising appointment today!